The TATA panic - a thread on opportunity and risk on different Tata Companies🔻

- Feb 6, 2025

- 7 min read

So first of all we wanna clarify that individually Tata companies are going through business crisis but on management level or as a group it’s not under any scam or fraud.

Starting the analysis with one less talked fact of Tata Group - Diversification.

You see there are many big business groups like Adani, Reliance, etc. but none of them have as many demerged companies as Tata group. Every company from Tata group from each small or big industry operates individually and listed as separate entity on stockmarket.

Why is this a plus point?

To make it investor friendly. Let’s understand it with a small example, If you’re investing in Reliance, you automatically get part of all it’s businesses like Retail, telecom, oil, etc. but what if you feel reliance has best growth opportunity only in its retail business? How can you invest just in that part of reliance? You can’t, Since it’s listed as consolidated firm. This becomes a problem for an investor and true potential of the company is never unveiled.

Tata Group operates differently, it has separate entity for every company it owns - be it Trent, Titan, Tata motors, Tata power, Tata chemical, Tata elxsi, Voltas, Tata steel, Tata communication, etc. This allows investors to choose company as per their preference to stay invested individually instead of being invested in whole group company.

Let’s get started with 3 TATA companies going through significant downturn :

1) Tata Motors : Most talked stock going through rough patch correcting more than 40% from top in last 3-4 months.

Before jumping on opportunity let’s understand the crisis of Tata Motors :

Increasing competition in EV passenger vehicle segment, resulting in reducing market share of EV segment.

Fall in demand signalled by its rising inventories. Meaning many cars/heavy vehicles have been manufactured and yet to be sold, this signals demand struggle.

Due to huge inventory funding capex for upcoming projects become difficult, especially when your debt level is already a bit high.

JLR sales decline in Europe and China, which reflects highest revenue in sales of the company.

Limited infrastructure fund allocated in budget to India, limiting growth potential for its Commercial Vehicles.

So how to find opportunities in this crisis :

Typically checking few facts of business like debt level around 1 and positive FCF will help us understand if company has enough resources to survive this period of rough patch or not. In case of Tata Motors debt level is around 1.05 with net cash of ₹30000 crores (almost 30% of total borrowings) and ₹52000 crores+ FCF of last 10 years.

Automobile stocks are highly volatile in nature, meaning bull run and bear market both are massive in the stock. But do remember a stock can only go down by 100% and up by 200-300-400%(or even more).

Understanding that company is going through demerger process between its Commercial Vehicle and Passenger Vehicle. Currently it has mix numbers of all its automobile companies, hence any downturn news related to CV or PV affects stock price. While after demerger the PV segment may get better valuations as per its recent growth trajectory of increasing market share from 6% to 13% fueled by EV demand.

This is not the first time company has faced crisis, in fact many people crying that they wish to buy stock in 2020, would be clouded by fear during that time because at that period stock was severely impacted by losses, slowed down revenue growth and economy emergency like COVID. Crash of stock price from ₹700 to ₹70 almost 90%, which was obviously massive. Of course the comeback was even more massive with more than 1000% returns within 4 years.

Let’s navigate when to enter this stock with current crisis - we will discuss both fundamental and technical perspectives :

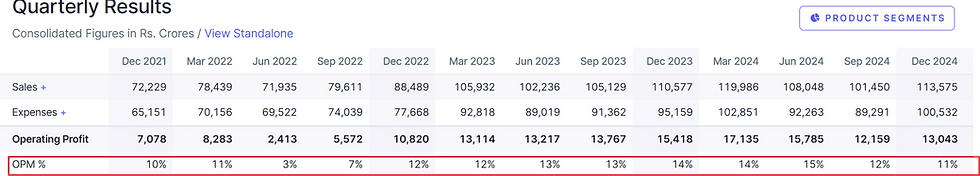

Fundamentally the risk averse entry would be when the inventory of the company starts reducing again along with indication of strong OPM margins.

This would indicate that company has got back demand for its products and it is able to sell them without any major discounts to attract customers.

When margins are stabilized and inventory starts declining, it’s a clear fundamental signal for a turnaround in automobile company.

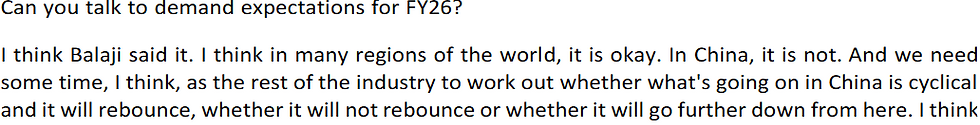

This should be supported by positive outlook by management of the company about industry and company. For eg : currently the decline in sales of China market for JLR segment is stressing Tata Motors growth the most, as stated by management in latest concall -

When we see some improvement in these areas of outlook from management, talking highly of a strong comeback in next 1-2 quarters, that will be clear indication of making some passive entry in stock supported by inventory indicator.

Just remember one thing, Stock starts factoring in expectations even before information/news is verified. Meaning whenever such instance comes around, stock may have already bounced back from its bottom, so don’t start chasing bottom and invest if valuations of the company are still favorable.

Other than this, if your risk appetite is high you can consider adding stock on every dip as long as company has favorable surviving resources (Controlled debt and high FCF).

Technical support level for the stock is shown in below setup :

2) Tata Power : while Tata Power is mostly recognized as solar sector stock due to huge orderbook from govt projects, its also aggressively working on setup of Charging stations for EV cars in India. Currently having highest market share of 55% in public charging stations and 85% in home charging stations.

What’s the crisis ?

Valuation, since 2023 solar stocks got too much valuation based on orderbook from govt itself. Tata Power being one of the most favorable companies, they got lot of speculation from retail and institutional investors.

Execution of solar projects remain key to growth, since solar projects are large in size it takes years to execute or operate on full capacity, this may impact short to medium term earning(profit) estimates of the company. Which has been seen in last 1-2 quarters that company didn’t meet street estimates.

High debt level and low interest coverage ratio, Debt to equity stands around 1.73 times. Which may be a threat if company doesn’t control it within next 1-2 years. The debt level has been increased in recent years more aggressively mainly to fund its capex for new projects which is normal for fast growing sectors like solar which need high capital investment.

Let’s find opportunities in this crisis :

After sharp correction the valuation seems to be cooled down to fair valuation. Although its still not undervalued, meaning if quarterly earnings don’t come out positive stock can go down further. However, current valuations look good for partial entries especially after Q3 which came out positive with strong outlook for next quarter as well.

Although due to new capex the debt level are higher, the company shown some good cash cushion with having more than ₹9000 crores in cash at end of 2024 and FCF of ₹18000 crores in 10 year time frame.

Credit Rating of the company is also stable and shows affirmation on liquidity, meaning there is low to 0 bankruptcy risk.

When can we consider to enter the stock ?

On fundamental perspective, a partial entry can be considered on current valuation but further entries can be planned as company reduces its debt level and converts orderbook into sales growth.

On technical perspective, stock is currently at support level and you can further plan your entries and exit as per the below chart :

3) Tata Elxsi : While company operates in tech industry, it also has its hand on R&D for different software development for AI used in industries like automobile, media and medical.

What’s the crisis ?

To understand crisis you will have to go back to the business segments of Tata Elxsi, so most of the revenue for company comes from Transportation, Media and Medical.

The best margins and low competition is found in media and medical sector. Hence when company increased its revenue from these sectors between 2018 to 2022, margins of the business expanded. At the same time company tried to cut off its non profitable businesses like semiconductor in 2021.

However recent crisis came in margins of the business when company shifted back its focus on transportation (automobile) sector, where competition is tight and margins are little lower.

Another major factor for limited growth for company was drop in demand from Europe due to bad economic conditions, company is yet to see recovery from there for new projects.

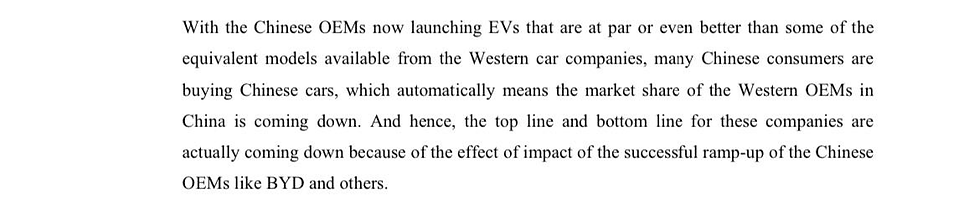

In recent con-call we also read management speaking on hard competition from Chinese market especially in EV sector. Let us explain this in more detail : Tata Elxsi has OEM (Original Equipment Manufacturer) clients meaning they serve companies like JLR, Nissan, etc. since Chinese companies are aggressively exporting their cars to other countries like US, UK and in-fact china market itself is prioritizing their domestic cars which provide even better features than US luxury cars.

Now Tata Elxsi serves many OEM companies of US,UK and Indian countries. Since these companies are facing competition and demand crisis, Tata Elxsi Company's sales pipeline is experiencing slowdowns.

How to find opportunity in this crisis ?

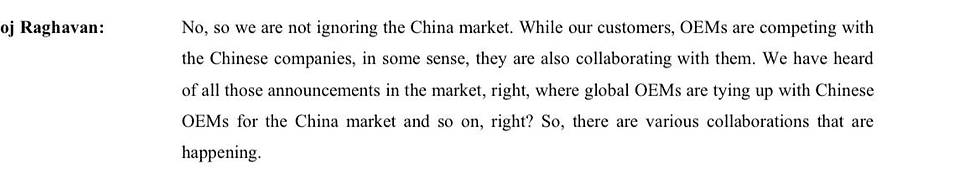

After Reading the con-call - management seemed trying to make best out of worst situation in Automobile crisis. Aiming to serve OEMs that don’t want to be dependent on Chinese companies for software data. This can serve opportunity for Indian companies, and management talked about indirectly collaborating with Chinese companies rather than competing with them.

Now in terms of transportation segment, management has shown signs that company is reducing its dependence on JLR slowly and building more long term deals with other OEMs.

Management also highlighted that it is trying to focus more on defence, commercial vehicle and aero space in transportation. Which has comparatively less competition than automobile companies.

Along with this, management highlighted that it has good deals lined up in media and medical sector which they didn’t disclose specifics of but seemed confident.

Beyond this, company has not been seeing major downturn for margins, profits or sales even after so many economic struggles globally.

On the point of financial resources, company has well maintained debt level, FCF and even SSGR is quite healthy.

When to take entry in stock ?

Fundamentally since company is already showing confidence on business recovery on some segments like transportation, media and medical. Making partial entry in stock seems sensible especially at current valuation.

Technically stock is on support level and for further entry levels, investors can refer the below chart setup :

Hope above analysis helps investor take a sound decision based on given rationals. Incase management outlook is updated, the same will be notified to Growthsquad premium members with updated recommendation. Regards,

Team GROWTHSQUAD SEBI Registered RA no. INH000017763